Context:

Recently, retail inflation surged to a nine-month high of 5.49% in September, a significant increase from 3.65% in August.

More on the News:

- This rise is primarily attributed to escalating food prices, particularly for fruits and vegetables (36% surge), as reported by the National Statistical Office (NSO).

- Food inflation, based on the Combined Food Price Index (CFPI), increased to 9.24 percent in September from 5.66 percent in August and 6.62 percent in the year-ago period.

Key Insights of NSO Report:

• Food Inflation Spike: Food and beverages, accounting for 45.86% of the Consumer Price Index (CPI), saw inflation climb to 8.36% in September, up from 5.30% in August. This reflects the substantial impact of food prices on overall inflation.

• Perishables Hit Hard: The inflation rate for perishables, particularly vegetables, soared to a 14-month high of 35.99% in September, compared to 10.71% in August.

- Fruits also experienced a notable rise, with inflation increasing to 7.65% from 6.45%.

• RBI’s Cautious Stance: The Reserve Bank of India (RBI) maintained the repo rate at 6.5% for the tenth consecutive time, emphasizing the need for vigilance due to inflationary pressures.

• Without including vegetables, food and beverage inflation dropped to a 59-month low of 3.9 percent in September.

• Regional Variations: Rural inflation rose to 5.87% while urban inflation reached 5.05% in September.

• Core inflation ‘non-food, non-fuel segment’ increased ed up to 3.5 per cent in September to an 8-month high.

- Notably, Bihar reported the highest inflation rate at 7.50%, contrasting with Delhi’s low of 3.67%.

Implications Ahead:

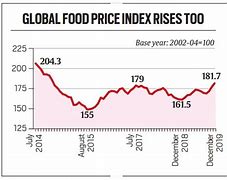

- With inflation showing an upward trend, experts predict continued monitoring will be essential. Factors like monsoon irregularities, rising global edible oil prices, and potential geopolitical tensions could further complicate the inflation landscape.

- Retail inflation is expected to remain high in October, around 5.3-5.5 percent, due to a mix of rising prices for fruits from festivals and increased costs for fats because of higher import duties.

- Economists anticipate that the RBI may need to adopt a cautious approach moving forward, delaying any potential rate cuts into 2025.

- The current inflation scenario underscores the importance of strategic measures to mitigate price hikes, particularly in the food sector.

Also Read:

Anusandhan National Research Foundation Launches PMECRG and MAHA-EV Mission