Syllabus:

GS3: Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Context: The Monetary Policy Committee of the Reserve Bank of India kept the repo rate unchanged, maintaining a neutral stance.

More on the News

- The Monetary Policy Committee (MPC) after assessing the current and evolving macroeconomic situation, unanimously voted to maintain the policy repo rate at 5.50%.

- The standing deposit facility (SDF) rate will be at 5.25 percent and the marginal standing facility (MSF) rate and the Bank Rate at 5.75%.

- The RBI retained its FY26 GDP growth forecast at 6.5% despite US tariffs on Indian imports.

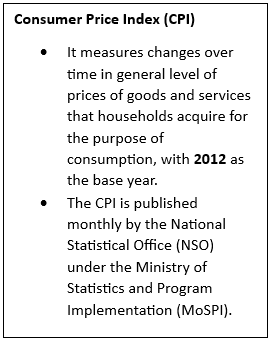

- Inflation for FY26 is projected at 3.1%, lower than June’s 3.7% estimate, though the Consumer Price Index is expected to reach 4.9% in FY27.

- According to the Governor of the RBI, India is contributing about 18% to the global growth which is more than the USA.

Monetary Policy Committee (MPC)

- The MPC in India is a statutory body established under the Reserve Bank of India Act, 1934.

- Specifically, Section 45ZB of the Act empowers the Central Government to constitute this six-member committee, which determines the policy interest rate needed to achieve the inflation target set by the Government of India.

- Under Section 45ZA, the Central Government, in consultation with the RBI, determines the inflation target in terms of the Consumer Price Index (CPI), once in five years.

- The MPC comprises six members, of whom three are from the RBI and three are appointed by the Central Government.

- RBI officials: the Governor (Chairperson), the Deputy Governor in charge of monetary policy and an RBI-nominated officer

- External members: appointed by the Central Government for four-year terms

- The Governor of the Reserve Bank of India acts as the ex officio Chairperson of the committee.

- Decision-making: By majority vote; the RBI Governor holds a casting vote in case of a tie.

- The MPC is required to meet at least four times in a year. The quorum for the meeting of the MPC is four members.

- Each Member of the Monetary Policy Committee writes a statement specifying the reasons for voting in favour of, or against the proposed resolution.

Tools for Implementing Monetary Policy

- Repo Rate: It is the interest rate at which the Reserve Bank of India (RBI) loans money to commercial banks. Specifically, it is the interest rate at which the RBI provides liquidity under the liquidity adjustment facility (LAF) to all LAF participants against the collateral of government and other approved securities.

- Standing Deposit Facility (SDF): The rate at which the RBI accepts uncollateralised deposits, on an overnight basis, from all LAF participants. The SDF rate is placed at 25 basis points below the policy repo rate. The SDF rate replaced the fixed reverse repo rate as the floor of the LAF corridor.

- Marginal Standing Facility (MSF): The penal rate at which banks can borrow, on an overnight basis, from the Reserve Bank by dipping into their Statutory Liquidity Ratio (SLR) portfolio up to a predefined limit (2 per cent). The MSF rate is placed at 25 basis points above the policy repo rate.