Syllabus:

GS2: Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes.

GS-3: Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment; Inclusive growth and issues arising from it.

Context:

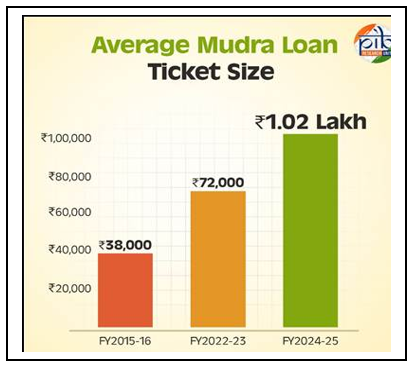

Recently, the Pradhan Mantri MUDRA Yojana completed 10 years with 53.85 crore loans amounting to over ₹35.13 lakh crore having been sanctioned, fueling grassroots entrepreneurship and expanding financial inclusion.

Pradhan Mantri MUDRA Yojana (PMMY)

PMMY under the Micro Units Development and Refinancing Agency (MUDRA), was set up by Government of India on April 8, 2015, for development and refinancing activities relating to micro units.

PMMY is a flagship Central Sector Scheme of the Government of India. The scheme facilitates micro credit/loan up to Rs. 20 lakhs to income-generating micro enterprises engaged in the non-farm sector in manufacturing, trading or service sectors, including activities allied to agriculture such as poultry, dairy and beekeeping.

It provides collateral-free financial support to micro and small enterprises (MSEs) across India and simplifies access fueling a nationwide entrepreneurial revolution.

PMMY covers varied sectors such as transport vehicles, community & personal services, food sector and textile sector.

Financial inclusion: Since its launch, the PMMY has sanctioned over 52 crore loans worth ₹32.61 lakh crore.

- Empowering Women: Women account for 68 % of all Mudra beneficiaries, underscoring the scheme’s role in advancing women-led enterprises across the country.

- Reaching Socially Marginalised Groups: According to the SBI report, 50% of Mudra accounts are held by SC, ST and OBC entrepreneurs and 11% of Mudra loan holders belong to minority communities.

MUDRA is a refinancing institution. MUDRA does not lend directly to micro entrepreneurs / individuals. The loans under Pradhan Mantri Mudra Yojana can be availed through eligible Member Lending Institutions (MLIs), which include:

- Public Sector Banks

- Private Sector Banks

- State-operated cooperative banks

- Rural banks from the regional sector

- Micro Finance Institution (MFI)

- Non-Banking Finance Company (NBFC)

- Small Finance Banks (SFBs)

- Other financial intermediary approved by Mudra Ltd. as a member financial institution.

Categorisation of loans

The scheme has been classified under four categories to signify the stage of growth/development and funding needs of the beneficiary micro unit/ entrepreneur.

- Shishu: Covering loans up to Rs. 50,000/-.

- Kishore: Covering loans above Rs. 50,000/- and up to Rs. 5 lakhs.

- Tarun: Covering loans above Rs. 5 lakhs and up to Rs. 10 lakhs.

- Tarun Plus: Loans up to Rs. 20 lakhs for entrepreneurs who have successfully repaid previous loans under the ‘Tarun’ category.

Mudra Card

- Mudra Card is an innovative credit product wherein the borrower can avail of credit in a hassle-free and flexible manner.

- It provides a facility for working capital arrangements in the form of an overdraft facility to the borrower.

- Since MUDRA Card is a RuPay debit card, it can be used for drawing cash from an ATM or through a Business Correspondent or make purchases using a Point of Sale (POS) machine.

- The facility is also there to repay the amount, as and when surplus cash is available, thereby reducing the interest cost.