SYLLABUS

GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

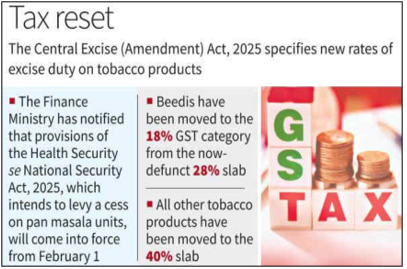

Context: The Union Ministry of Finance notified a new taxation framework for tobacco and pan masala products to take effect from February 1, 2026, replacing the GST compensation cess regime.

More on the News

• The Ministry of Finance issued multiple notifications on January 1, 2026 to operationalise the new taxation regime for tobacco products.

• The Central Excise (Amendment) Act, 2025 will come into force from February 1, 2026, introducing revised excise duty rates on tobacco products.

• Provisions of the Health and National Security Cess Act, 2025 relating to pan masala manufacturing will also take effect from the same date.

• February 1, 2026 has been notified as the date from which the GST compensation cess will cease to exist.

- The compensation cess was originally introduced for five years to compensate States for GST-related revenue loss and was extended till 2026 due to COVID-19-related shortfalls.

• With the repayment of GST compensation loans nearing completion, the cess has been fully withdrawn from all goods, including tobacco products.

Key Features of the New Tobacco Tax Regime:

• Post-cess fiscal restructuring: The GST compensation cess is replaced with a combination of higher GST rates, additional excise duty, and a new health and national security cess.

• A Health and National Security Cess will be levied on pan masala, while tobacco products will attract additional excise duty over and above GST.

• Strengthening deterrence through specific taxation: The excise duty structure has been revised to maintain a high overall tax incidence after the withdrawal of the compensation cess.

- Gutkha: highest excise duty of about 91 percent

- Chewing tobacco and jarda scented tobacco: attract around 82 percent duty

- Cigarette: excise duty rates vary by length and filter type and range from ₹2,050 to ₹8,500 per thousand sticks.

- Pipe and cigarette smoking mixtures: attract an exceptionally high excise duty of 279 percent.

• Handmade bidis have been given concessional treatment with a duty of ₹1 per thousand sticks to protect the livelihoods of workers.

• Valuation and Production-Based Taxation:

- A new valuation mechanism has been introduced for smokeless tobacco based on the retail sale price declared on the package.

- For chewing tobacco and gutkha manufacturers, excise duty will be linked to the number and speed of packing machines.

Compliance and Monitoring Measures

• Manufacturers are required to install functional CCTV systems covering all packing and production areas.

• CCTV footage must be preserved for a period of 48 months to enable audit and enforcement.

• All manufacturers must file a detailed declaration of production capacity and machine specifications in Form CE DEC-01 by February 7, 2026.

• Machine speed and technical specifications must be certified by a Chartered Engineer through Form CE CCE-01.

• Export of notified tobacco products will be permitted only after payment of applicable duties.

Rationale Behind the Policy Shift

• Correcting Regressive tax outcomes: Lower specific excise duties under GST made cigarettes relatively more affordable, particularly for low-priced segments, diluting public health objectives.

• Alignment with WHO–FCTC recommendations: The new regime aligns with global public health guidance that recommends periodic increases in specific excise duties.

- The World Health Organization Framework Convention on Tobacco Control (WHO-FCTC) requires countries to implement legally binding, evidence-based measures to reduce tobacco demand and supply.

• National priorities: The Health and National Security Cess has been justified as a dedicated and non-lapsable funding source for national security needs.

• Administrative simplification for enforcement agencies: CCTV mandates and machine-linked taxation improve monitoring efficiency and reduce litigation over valuation disputes.