Context:

Recently, India surpassed China to become the top-weighted nation in the Morgan Stanley Capital International (MSCI) Emerging Market Investable Market Index (IMI) for the first time.

More on the News

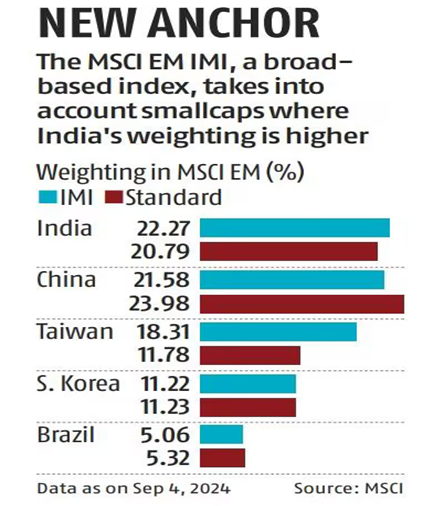

- India’s weight in the index now stands at 22.27%, surpassing China’s 21.58%.

- The rebalancing mirrors broader market trends, with Chinese markets struggling due to economic challenges, while India’s markets have gained from favourable macroeconomic conditions.

- Key factors contributing to this positive trend include a 47% increase in foreign direct investment (FDI) in the early part of 2024, decreasing Brent crude prices, and substantial foreign portfolio investment (FPI) in Indian debt markets.

- This shift highlights India’s strong performance in the equity market and its growing appeal to global investors and may lead to 4 to $4.5 billion in equity inflows.

- On the main MSCI EM index (standard index), China’s weight exceeds India’s by 320 basis points (China’s 23.98% vs. India’s 20.79%). However, this gap has narrowed dramatically. At the beginning of 2021, China’s 38.7% weighting was much greater than India’s 9.2%.

- The EM Investable Market Index (IMI) is an offshoot of the main MSCI EM index.

- While the main MSCI EM index (standard index) covers the large and midcap space, the IMI includes a more comprehensive range, encompassing large, mid, and small cap stocks.

About MSCI EM Investable Market Index

- The MSCI Emerging Markets Investable Market Index (IMI) captures large, mid and small-cap representation across 24 Emerging Markets (EM) countries.

- With 3,355 constituents, the index covers approximately 99% of the free float-adjusted market capitalization in each country.

- The top three constituents on the Index are Taiwan Semiconductor Manufacturing Company (TSMC) (8.09%), Tencent (3.6%), and Samsung (2.96%).

- Among Indian companies, Reliance Industries (1.22%), Infosys (0.86%) and ICICI Bank (0.85%) are among the top 10 constituents of the index.

Free float-adjusted market capitalization

- It is a method of calculating a company’s market value by considering only the shares that are available for public trading.

- It excludes shares that are held by insiders, promoters, or the government, which are not readily available for trading.

- This method provides a more accurate reflection of the market’s perception of a company’s value, as it only includes shares that can be actively traded.

Free Float Adjusted Market Capitalization= Share PriceX (Total Shares Outstanding−Restricted Shares)

Significance of the Index

- The increase in India’s weight in the MSCI EM IMI, along with the relative decline in China’s weight, highlights the growing importance of the Indian market in the global investment landscape.

- It is expected to attract significant inflows into Indian equities, providing a boost to the country’s economic growth and development.