SYLLABUS

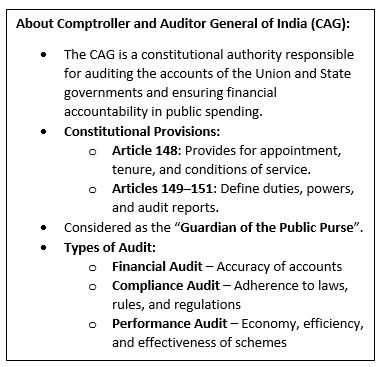

GS-2: Appointment to various Constitutional Posts, Powers, Functions and Responsibilities of various Constitutional Bodies.

GS-3: Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

Context: Recently, CAG released the second edition of the Publication on State Finances 2023–24, presenting a consolidated, audited overview of the finances of all 28 States, which will enable inter-State and inter-temporal analysis over a 10-year period from 2014-15 to 2023-24.

Key findings of the Report

- States’ Own Tax Revenue (SOTR) as the single largest source of income: In 2023–24, the combined SOTR of all 28 states stood at about Rs 18.8 lakh crore, accounting for nearly 50% of their total revenue receipts and 6.49% of aggregate Gross State Domestic Product (GSDP).

- Transition towards own-resource mobilisation: Over the past decade, SOTR has averaged around 47% of states’ revenue receipts, pointing to a gradual shift towards own-resource mobilisation, even as transfers from the Union government remain significant.

- Goods and Services Tax (GST) Engine: In post-GST period, average annual SOTR growth accelerated to about 11.7% during 2018–19 to 2023–24, compared with 10.5% in the pre-GST years.

- State’s Fiscal Position

- Total Public debt: Around ₹67.87 lakh crore (23% of GSDP) by March 31, 2024.

- Fiscal deficits: 18 states exceeded the 3% of GSDP benchmark set by the 15th Finance Commission.

- Disparity in States’ capacity to mobilise own tax revenues: Industrialised and consumption-driven states such as Maharashtra, Karnataka, Tamil Nadu, Gujarat, Telangana and Haryana together accounted for around 60% of total SOTR. In contrast, several north-eastern and hill states continue to depend heavily on central transfers, with SOTR contributing less than 20% of revenue receipts in some cases.

- Weakened Revenue buoyancy: In 2023–24, the overall buoyancy ratio fell below one. This indicates tax revenues grew marginally slower than nominal GSDP (Gross State Domestic Product), signalling emerging pressures from economic moderation, limits to compliance gains, and structural constraints in expanding tax bases.

- Budgetary Rigidity: Committed expenditure remained a major pressure point on state finances in FY24, significantly constraining their ability to redirect spending towards development and capital investment.

- Committed expenditure—comprising salaries, pensions and interest payments—absorbed 43.3% of the combined revenue expenditure of all states in FY24.

- Wide inter-State variations: Committed expenditure ranged from about 73% of revenue expenditure in Nagaland to nearly 31% in Maharashtra.

Key Recommendation in the Report:

- Strengthen tax administration: Improve GST compliance, rationalize stamp duties, and leverage digital tools to expand fiscal space without excessive reliance on borrowing or central transfers.

- Ease long-term fiscal stress: Need sustained efforts to contain debt, rationalise subsidies, improve efficiency in public employment, and transition towards contributory pension schemes are essential.

- Harmonisation and rationalisation of Expenditure: A Structural reform advised by the CAG for adoption from FY 2027-28, to address long-standing issues of non-uniformity in classification, transparency gaps such as “shadow budgeting”, and improve comparability of public expenditure data at the Object Head level.

Significance of the report

- Holistic State’s Fiscal Information: Unlike the annual Finance and Appropriation Accounts and Audit Reports, which are placed before State Legislatures, this publication brings together comparable audited fiscal data across States in a single, accessible volume.

- Digital Integration: To enhance accessibility and usability, the State Finances 2023-24 publication is accompanied by interactive dashboards and data visualisation tools, available on the CAG’s website.

- Support evidence-based policymaking: The publication enhances fiscal transparency and assists policymakers, public financial managers, researchers, academia and other stakeholders in strengthening the public finance discourse.