SYLLABUS

GS-3: Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment.

Context: Recently, the Reserve Bank of India (RBI) notified the Foreign Exchange Management (Borrowing and Lending) (First Amendment) Regulations, 2026.

More on the News

• The amendment revises the External Commercial Borrowing (ECB) framework under FEMA to rationalise limits, strengthen monitoring, and align the rules with evolving global financing practices.

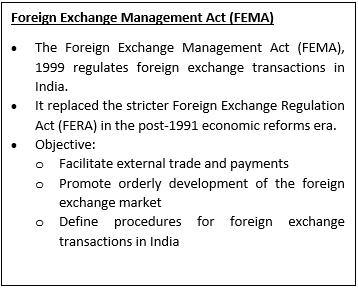

• The amendment introduces structural changes to the ECB regime under the Foreign Exchange Management Act (FEMA), 1999.

- External Commercial Borrowing (ECB) refers to commercial loans raised by eligible Indian entities from recognized non-resident lenders.

• The revised regulations were finalised after stakeholder consultations on the draft released in October 2025.

• Existing ECBs will continue under the earlier framework, but reporting must follow the new compliance norms.

Key Highlights of the Amendment

• Expanded Eligible Borrowers and Lenders: Any non-individual resident entity incorporated under Indian law can raise ECB from recognised overseas lenders, including IFSC-based institutions.

• Revised Borrowing Limits: ECB borrowing is capped at the higher of USD 1 billion or 300% of net worth, with exemptions for regulated financial entities.

• Minimum Average Maturity Period (MAMP): The standard MAMP is 3 years, while manufacturing entities can access shorter maturities (1–3 years) within prescribed limits.

• Cost of Borrowing Liberalised: Borrowing costs are largely market-determined, with ceilings only for very short-term loans and arm’s-length pricing for related-party ECBs.

• Currency Flexibility: ECBs can be raised in foreign currency or INR, with permitted currency conversion under safeguards.

• End-Use Restrictions Strengthened: ECB proceeds cannot be used for activities like real estate, chit funds, capital markets, certain agriculture uses, NPA-linked refinancing, or prohibited on-lending.

• Reporting and Compliance Reforms: Updated reporting mandates include ECB-1/ECB-2 filings, stricter timelines, late submission fees, and new compliance disclosures.

• Treatment of ECB Proceeds: ECB funds must flow through designated AD banks and can be temporarily parked in approved short-term instruments until use.

Significance of the Amendment

• Rationalisation of ECB Framework: The amendment simplifies borrowing limits and eligibility, making the framework more transparent and rules-based.

• Improved Access to Global Capital: A wide borrower and lender base enhances access to overseas funds and boosts capital inflows.

• Stronger Regulatory Oversight: Tighter end-use restrictions and improved reporting strengthen prudential supervision.

• Support to Manufacturing and Infrastructure: Relaxed maturity norms encourage long-term investment in the productive sector.

• Prevention of Financial Misuse: Curbs on NPA refinancing and speculative uses reduce regulatory arbitrage and evergreening.