Syllabus:

GS3: Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

GS3: Infrastructure: Energy, Ports, Roads, Airports, Railways etc.

Context:

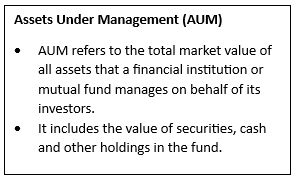

According to Knight Frank India’s latest study, the total Assets Under Management (AUM) of Infrastructure Investment Trusts (InvITs) in India hit $73 billion in FY 2025 and are projected to grow 3.5 times to $257.9 billion by 2030.

Key Findings of the Report

- The report positions India as a rising global infrastructure investment hub, ranking 4th in Asia with a combined REIT and InvITs market cap of USD 33.2 billion as of July 2025.

- Central government infrastructure spending rose 6.2 times from $12 bn in FY 2015 to $75 bn in FY 2025, increasing from 0.6% to 2.0% of GDP, highlighting a strong push for infrastructure-led growth.

- Infrastructure development will be crucial to achieving India’s $7 trillion economy target, which Knight Frank estimates will require $2.2 trillion in investment.

- Globally, over 1,000 publicly listed REITs and InvITs have a combined market cap of around $3 trillion. In contrast, India has five REITs and 17 InvITs with a total market cap of $33.2 billion.

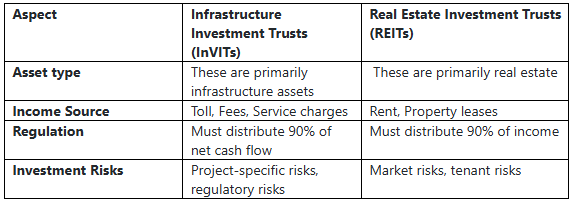

Differences between REITs and InVITs

National Monetisation Pipeline (NMP)

• As announced in Budget 2021-22, the National Monetisation Pipeline (NMP) lists core assets of central ministries and PSEs for monetisation from 2021-22 to 2024-25.

• The NMP included assets with monetisation potential of Rs. 6 lakh crores during the four years. The total target for the first two years, i.e., 2021-22 and 2022-23, under NMP was around Rs. 2.5 lakh crore, against which around Rs. 2.30 lakh crore was achieved.

• During the financial year 2023-24, against the target of Rs. 1.8 lakh crore, which is the highest among all four years, the achievement has been around Rs. 1.56 lakh crore.

• Further, this achievement in 2023-24 is around 159% of the achievement in 2021-22.

• National Monetisation Pipeline (NMP 2.0)

- NMP 2.0 was announced in the Union Budget 2025–26.

- It targets INR 10 trillion worth of assets for monetisation by 2030 with InvITs positioned as a key financing channel.